Charitable Tax Credit

Contributions to Qualifying Charitable Organizations

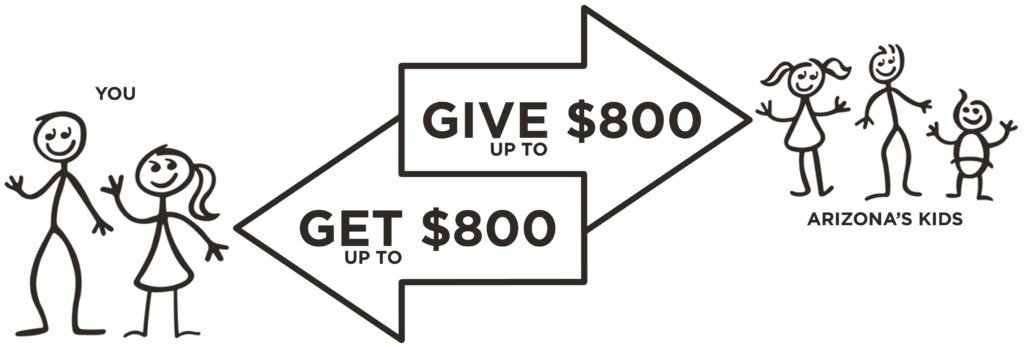

Support Arizona’s children and receive up to $841 back on your Arizona taxes in 2023!

Arizona offers you a dollar-for-dollar tax credit when you invest in Southwest Human Development, a Qualifying Charitable Organization (QCO Code: 20390). Your donation qualifies for a state tax credit of up to $841 if filing jointly and up to $421 for individuals. Plus, you remain eligible for all other state tax credits to support schools, foster care and veterans organizations. To learn more, visit the Arizona Department of Revenue website.

To make a contribution by phone, please call (602) 808-GIVE (4483) or to donate by check download a contribution form to be mailed.

Looking to give using your donor advised fund? Click here to learn more and donate today!

Would you like more information on making a gift through your will or trust? Click here to learn more or call David Reno at 602-769-3958.

Southwest Human Development does not offer tax advice. Always consult with a qualified, licensed professional regarding all tax-related issues.

Southwest Human Development is a 501(c)(3) nonprofit organization (Federal Tax ID #86-0407179) and a qualifying nonprofit organization for the Arizona Charitable Tax Credit (QCO Code 20390)